south carolina inheritance tax 2019

2019 the New York estate tax exemption amount will be the same as the. Iowa has a separate inheritance tax on transfers to others than lineal ascendants and descendants.

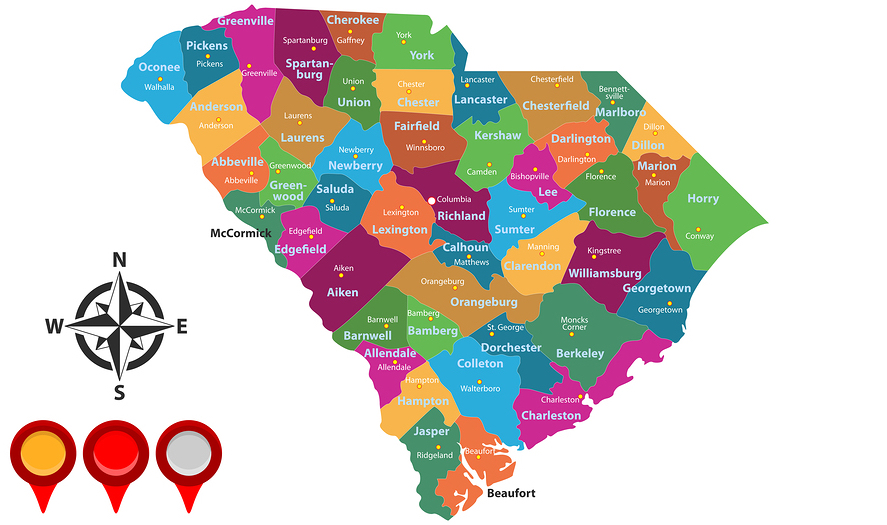

Home Abbeville County South Carolina

Heres a quick summary of the new gift estate.

. Estate Trust Tax Services. Creating a will is oftentimes the first step that South Carolina residents must take in estate planning. South Carolina residents do not need to worry about a state estate or inheritance tax.

The federal estate tax is levied on a propertys taxable part before the heir transfers the assets. 8 00 9 TAX on excess withdrawals from Catastrophe Savings. Massachusetts has the lowest exemption level at 1 million and DC.

Currently South Carolina does not impose an estate tax but other states do. Do Your 2021 2020 any past year return online Past Tax Free to Try. South Carolina does not have these kinds of taxes.

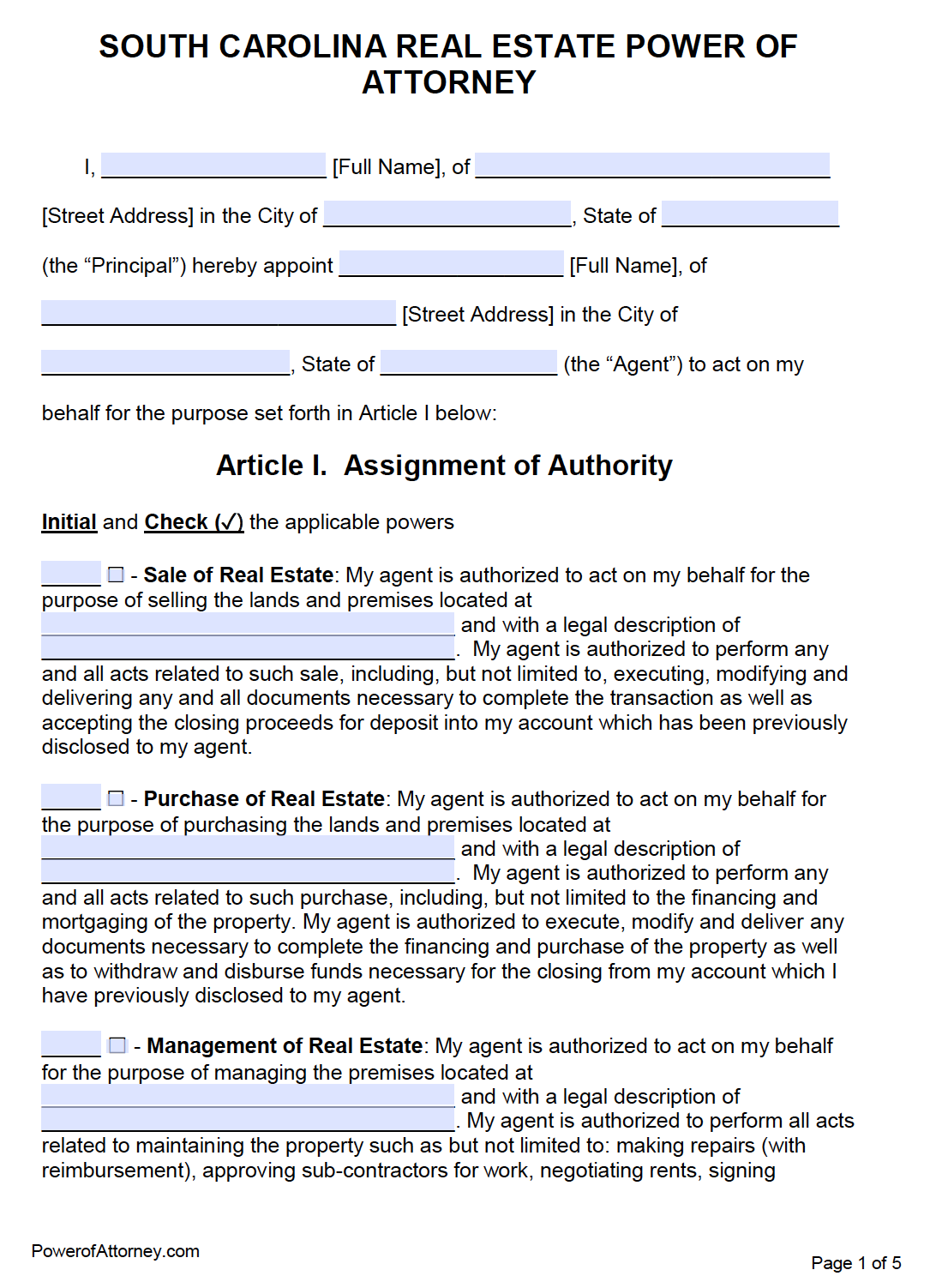

South Carolina has no estate tax for decedents dying on or after January 1 2005. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Learn How EY Can Help.

If they are married the spouse may be able to leave everything to each other without paying any. South Carolina Personal Income Tax. South Carolina charges a progressive income tax on its residents ranging from 0 at the lowest bracket to 7 at the highest bracket.

Extension SC8736 South Carolina Department of Revenue. Ad Committed to Delivering High-Quality Tax Services for Sophisticated Financial Needs. Ad Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

It has a progressive scale of up to 40. Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption. November 2019 3 october 2019 2 september 2019 3 august 2019 4 july 2019 2 Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025.

Easy Fast Secure. 7 TAX on Lump Sum Distribution attach SC4972. Has the highest exemption level at 568 million.

However according to some. Of the six states with inheritance taxes Nebraska has. Ad Do Your 2021 2020 2019 2018 Taxes in Mins Past Tax Free to Try.

7 00 8 TAX on Active Trade or Business Income attach I-335. - 38 - - - 2020-09-14 - 2020-09-15 040742 - 12. South Carolina Department of Revenue.

Find out whats changed in 2019 for inheritance law. South Carolina residents do not need to worry about a state estate or inheritance tax. A married couple is exempt from paying estate taxes if they do not have children.

Governor Henry McMaster recently signed a bill allowing for the creation of a statewide filing. The requirements for a valid will change from state to state but are pretty. Easy Fast Secure.

In January 2013 Congress set the estate tax exemption at 5000000.

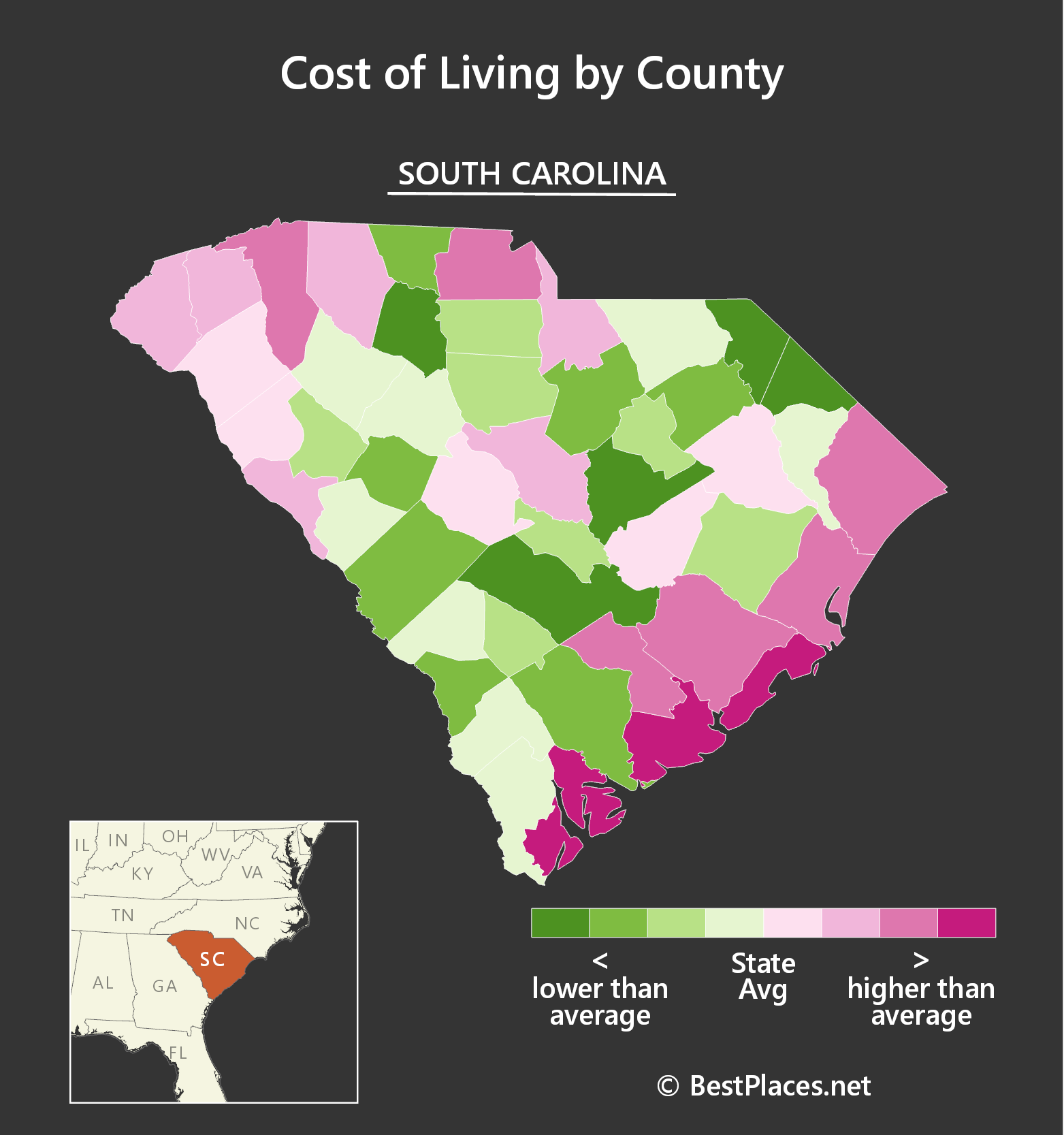

Ultimate Guide To Understanding South Carolina Property Taxes

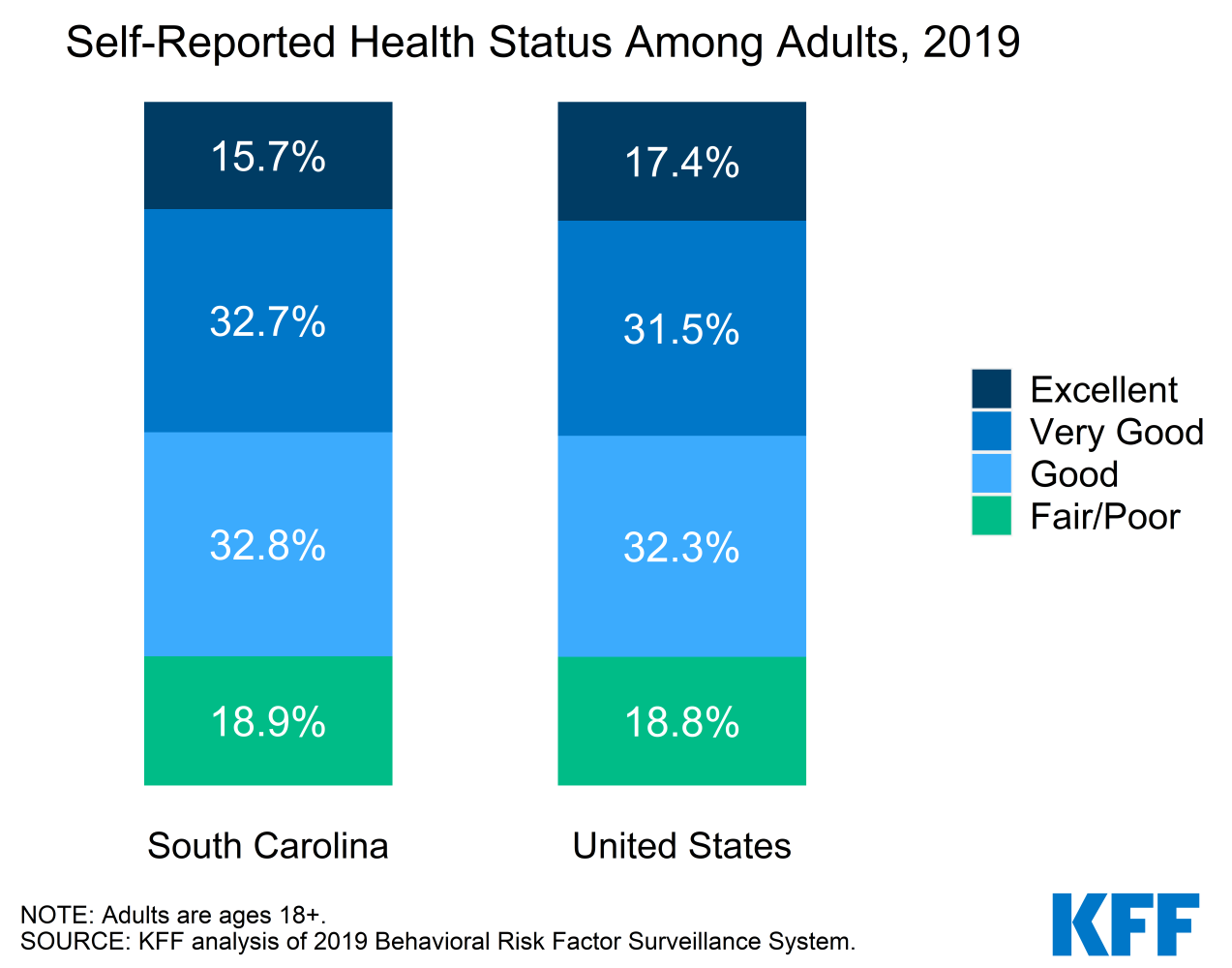

Election 2020 State Health Care Snapshots South Carolina Kff

Free Real Estate Power Of Attorney South Carolina Form Pdf Word

12 Best Places To Live In South Carolina

Complete E File Your 2021 2022 South Carolina State Return

Free Durable Power Of Attorney South Carolina Form Pdf

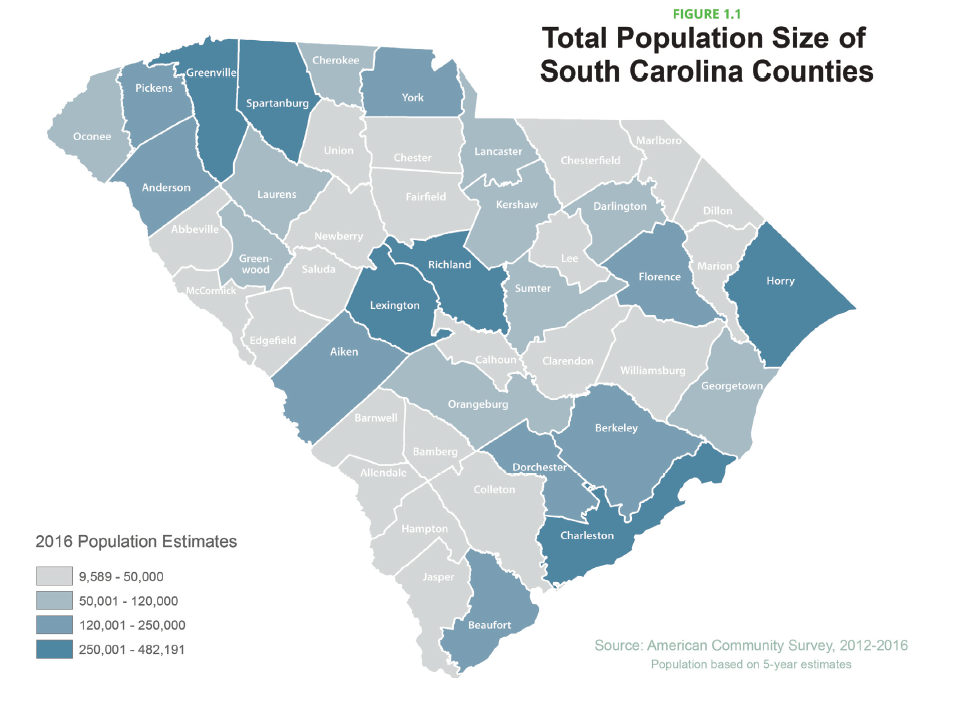

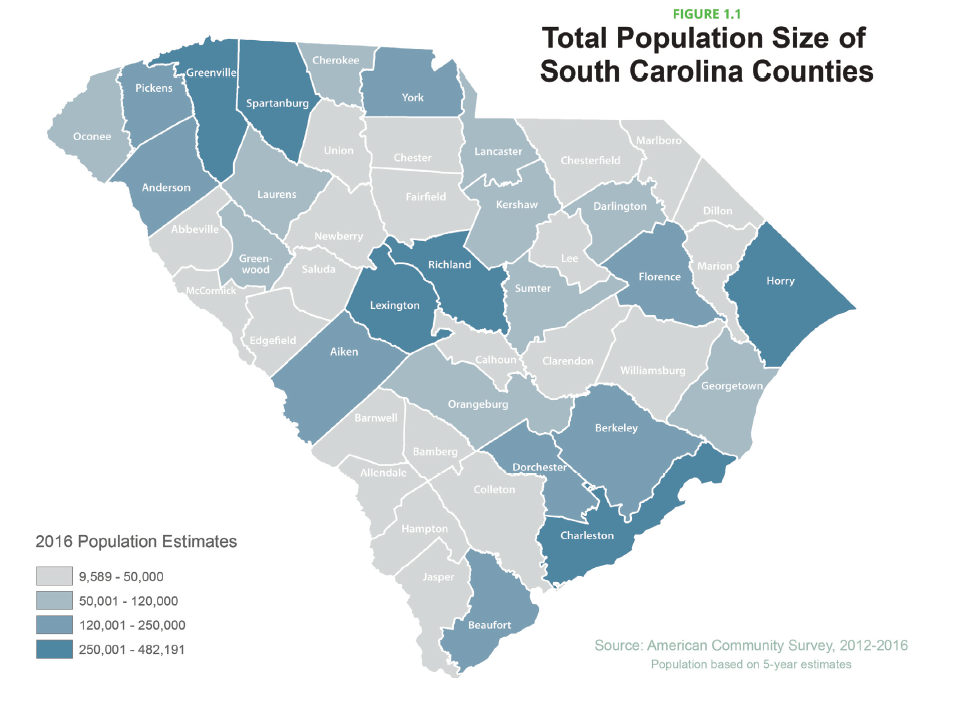

See How South Carolina S Counties Are Growing And Shrinking Gem Mcdowell Law 843 284 1021 Estate Business Law Local

Breaking 2nd Earthquake Of Day Hits South Carolina Cbs 17

Best Places To Live In Greenville South Carolina

2022 Best Places To Live In South Carolina Niche

South Carolina And The 19th Amendment U S National Park Service

The True Cost Of Living In South Carolina

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

South Carolina Income Tax Calculator Smartasset

South Carolina Health At A Glance 2018 Live Healthy State Health Assessment Report Demographics Scdhec

The Pros And Cons Of Retiring In South Carolina

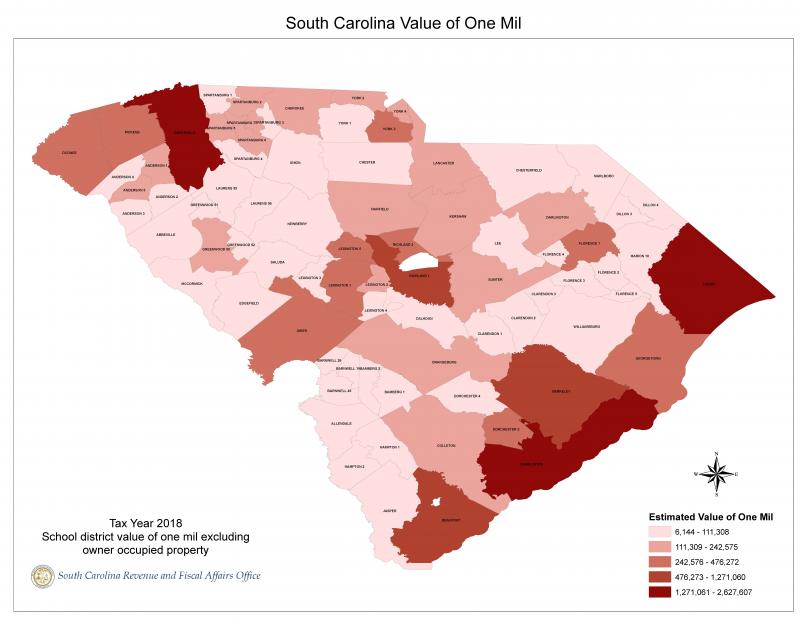

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office